Connecting Owners and Successors and Empowering Business Transitions

At PensioTec, we are a team of kind and passionate people with deep expertise in finance, product, design, engineering, and technology. Our values are trust, empowerment, integrity, and clarity.

With decades of combined experience in finance, innovation, technology, automation, and B2B2C solutions, our team is dedicated to creating intuitive technologies that simplify complexity and unlock new opportunities for individuals and businesses alike.

World class team

Founder and Director

Hetty Samosir, MFin

Hetty Samosir founded PensioTec in 2025 to empower people with next-generation M&A SMEs solutions and financial literacy tools.

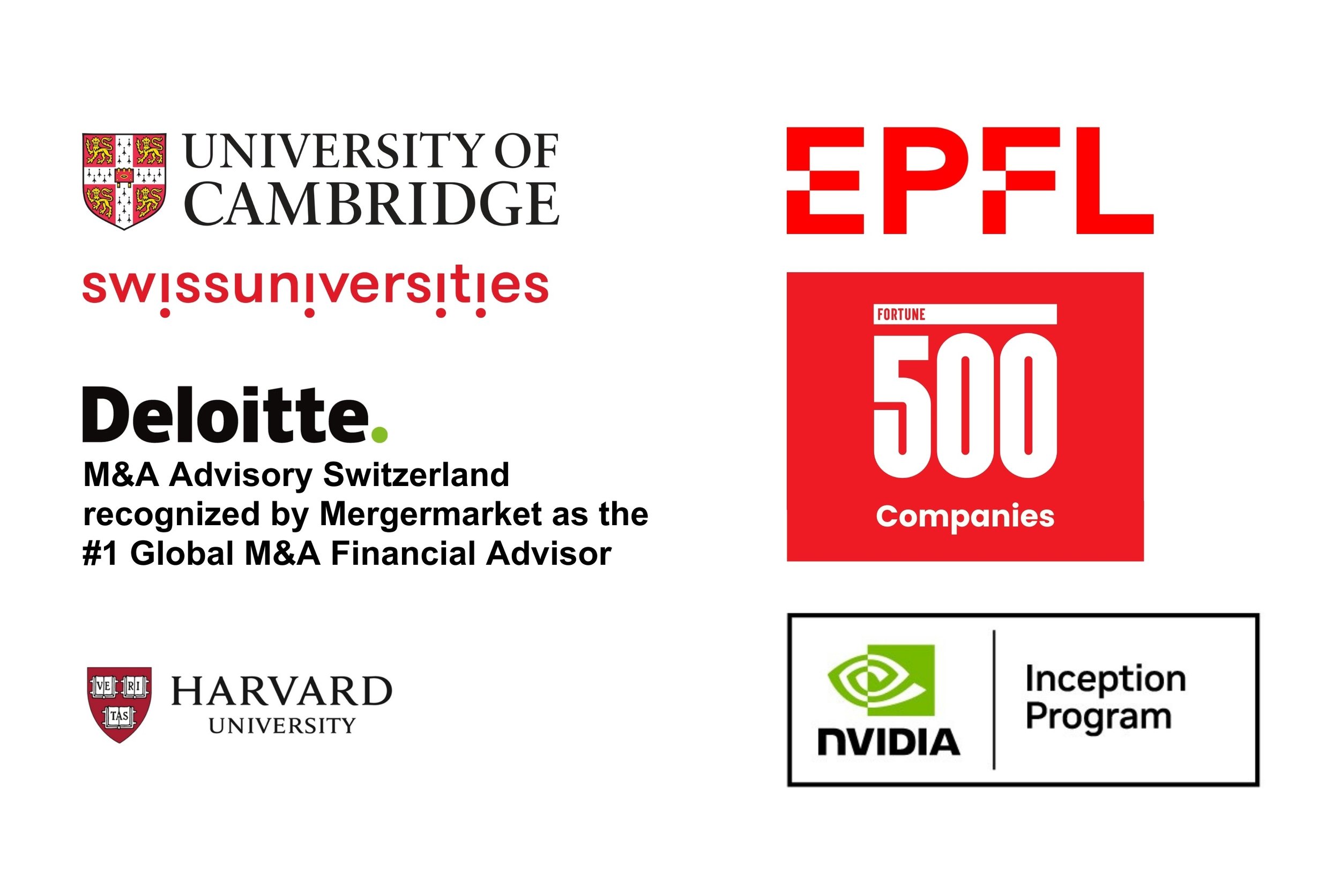

Previously, a member corporate finance at AmerisourceBergen (now Cencora) in Switzerland, a company with over $150 billion in revenue, where she supported multi-billion-dollar P&Ls and large-scale transactions worth hundreds of millions of dollars. Later, a Mergers & Acquisitions (M&A) Consultant of the Financial Advisory at Deloitte Switzerland, she realized that to truly deliver smarter M&A buy-and-sell and financial literacy solutions, she would need to build it through a startup. Hetty holds a Master of Finance from the University of Cambridge, a B.Sc. in Banking and Finance from Bern University of Applied Sciences in Switzerland, and a Bachelor’s Degree in Physics from the University of Lampung in Sumatra, Indonesia, where she also participated in U.S. exchange programs. Her thesis research on artificial intelligence, partnered with leading AI experts. Hetty is an avid reader, hiker, university-championship level polo player, a keen painter and skilled in interior design. She has held multiple leadership roles, including serving as Curator and Vice Curator of the WEF Global Shapers Hub in Bern, Switzerland and the University of Cambridge JBS MFin Teaching Committee Reps.

Co-Founder and CTO

Patrick Gono, PhD

Patrick Gono earned his PhD in Physics from EPFL, Switzerland: first-principles quantum simulations, following his MSc and BSc in Physics from Masaryk University.

Previously, he worked as a Software Engineer at AoT, a $40M-funded robotics venture, and as a squad leader for nano technology company, including Nanosurf, with $30M+ in revenue.

Patrick’s technical expertise spans C++, Python, and game development, complemented by strong project management and cross-border engineering leadership.

Beyond technology and science, Patrick is an avid reader, a skilled chef and pâtissier, a keen painter, and formerly served as President of the PhD Physics Student Association at EPFL. He was also a judge in the International Physicists’ Tournament and the Young Physicists’ Tournament.

Recently joins PensioTec, Oxford MBA intern

Shazwan Syahrunizam

Shawzan recently completed his MBA at Saïd Business School, University of Oxford, and an internship at Amazon UK. He brings expertise in banking and consumer tech.

How We Met

Hetty, Patrick, and Joel (quantum tech and AI expert) became close friends outside of work, spending evenings at pub quizzes on science, pop culture, and general knowledge, cooking together, painting regularly, and even debating episodes of Succession (which, admittedly, none of us truly enjoyed). Our friendship grew after we moved to Basel-Stadt, Switzerland, for our previous roles. We met Shazwan during the Oxford MBA tour to Swiss banks and family offices in Zurich, where a shared curiosity for finance and innovation quickly turned into friendship.

United by purpose and passion, we’re a team of curious outliers who believe that meaningful change starts when you question the way things have always been done.

Our vision has been validated on stage: we were awarded the Winner of Startup Pitch at the University of Cambridge’s IGNITE program, judged by a panel that included a Partner from Amadeus Capital, one of Europe’s most respected venture firms.

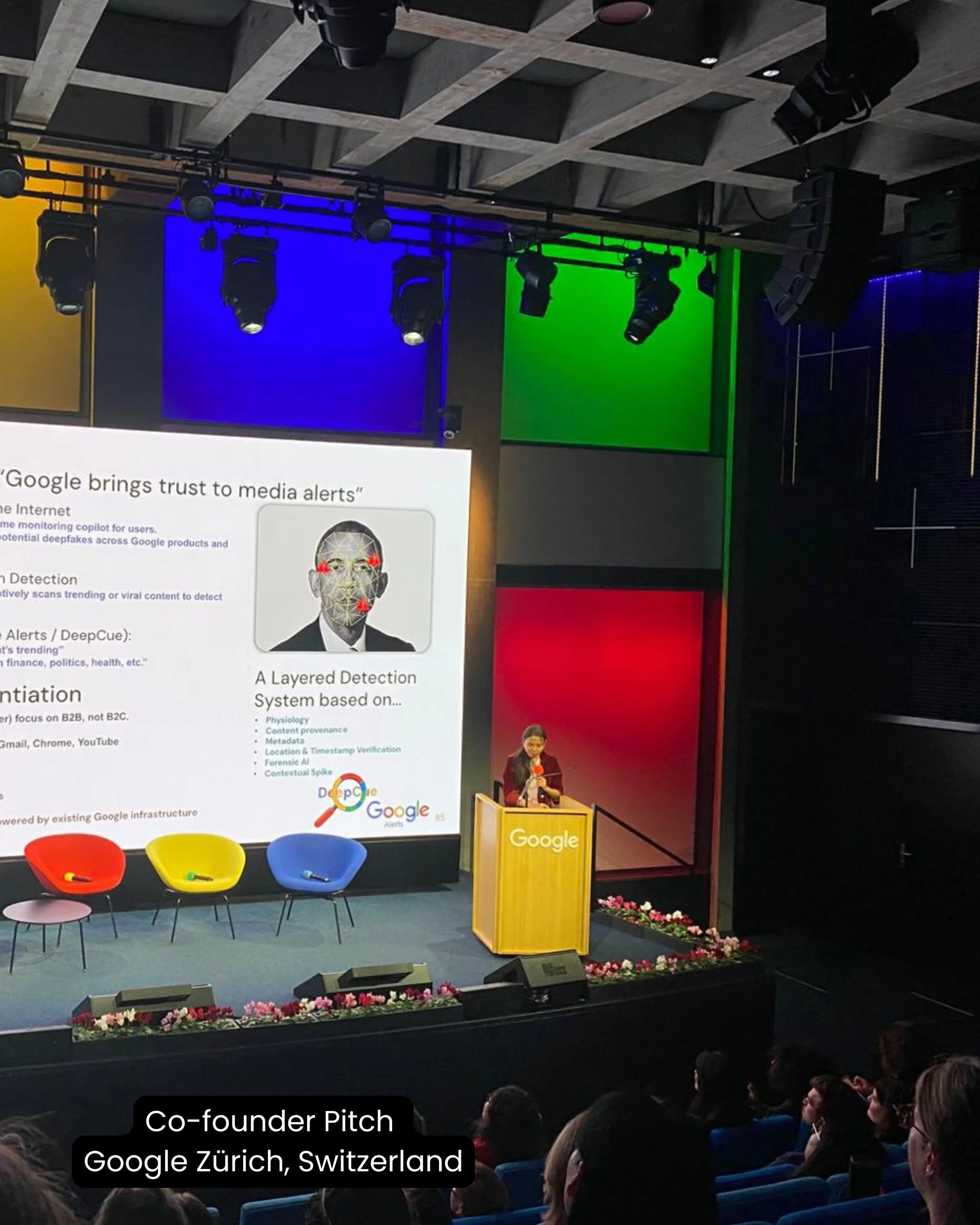

Google UK & Ireland recently selected PensioTec as one of the Top 20 semifinalists in their Next Unicorn program, in collaboration with Proximo Ventures.

We have learned directly from world-class and unicorn founders through in-person workshops and sessions.

Our Story

It began with a simple but urgent question: Why do so many working adults fail to contribute to a pension? Digging deeper, I realized the problem was far bigger: the world is facing a massive financial literacy gap (OECD/INFE, 2023). 37% of small business owners don’t think they make enough profit to save for retirement (Score, 2019). Through my discovery interviews, I learned that many owners ultimately expect to fund their retirement by selling their businesses.

During my bachelor’s studies in Banking and Finance in Bern, I worked closely with Swiss SMEs. In 2018, I joined a Fortune 500 company, Deloitte Switzerland, and later completed my Master of Finance at the University of Cambridge. Across all of these experiences, one pattern became impossible to ignore: most SME owners have no clear succession plan, even though for many of them, their business is their retirement plan.

At the same time, younger professionals were seeking autonomy and meaningful participation in the economy. They do not refuse to work; they refuse to wait for systems that no longer reflect how they live, think, or create value.

That realization became the foundation of PensioTec.

When I think about the projects that shaped me, the ones that stayed with me the most were with SMEs. I still remember a candle maker in a small Swiss suburb who started in a cow stable, hand-pouring every candle. Over the years, he built a production site that created jobs and preserved a local craft.

Stories like his remind me why PensioTec exists: to honour the legacy of SMEs, to support the generations who built them, and to empower the next generation to take the torch forward.

So I began forming a team with deep technical expertise, strong domain knowledge, and a shared belief one core principle: the future of business succession and financial empowerment must be accessible, next-gen, and human-centered.

— Hetty Samosir

Our Founder joined global innovators at the World Economic Forum Annual Meeting in Davos, watch the session here

PensioTec’s mission

supports several key SDGs:

Expanding financial literacy & secured solutions to reduce poverty risks.

Delivering lifelong financial learning tools.

Promoting financial security to support mental and social well-being.

Building digital financial infrastructure.

Expanding financial access for underserved groups.

Designing inclusive solutions that empower women.

Supporting SME business succession and entrepreneurship.

Collaborating with institutions to drive systemic change.

Our values

Create ripple effects

Even the smallest step toward a succession plan, a business transition, or a future exit can create ripple effects that secure jobs, protect communities, and preserve decades of entrepreneurial hard work.

Empower others

We grow stronger together. By connecting business owners, buyers, advisors, and communities on one platform, we empower people with smarter tools. When entrepreneurs thrive, communities thrive with them.

Create lasting impact

We build technology that makes business transitions accessible, responsible, and sustainable. By helping owners exit smoothly and enabling buyers to grow the next generation of SMEs, we strengthen local and global economies while promoting practices that protect our precious planet.